Imagine owning a piece of digital art that’s not just a pretty picture on your screen but a verifiable asset worth millions, or earning real money by playing a video game in a virtual world. Sounds like science fiction? Welcome to the era of digital assets, where pixels are turning into profits and redefining what we consider valuable. In a world increasingly lived online, digital assets like cryptocurrencies, NFTs, and tokenized real-world items are disrupting traditional notions of ownership, investment, and economy. This comprehensive guide explores how these innovations are reshaping value, backed by the latest stats and insights as of September 2025. Whether you’re a beginner wondering how to start with digital assets or an experienced investor seeking market trends, we’ll cover everything you need to know to make informed decisions.

Understanding Digital Assets: What They Are and Why They Matter

Digital assets mark a new era in finance and property ownership. At their core, they are intangible items secured on blockchain technology, a decentralized ledger that guarantees security, transparency, and permanence. Unlike traditional assets such as stocks or real estate, digital assets exist in the virtual space but hold tangible real-world value. Businesses looking to leverage this technology can benefit from blockchain development services to create secure, custom solutions for managing these assets.

Key types of digital assets include:

- Cryptocurrencies: Digital currencies like Bitcoin (BTC) and Ethereum (ETH) used for transactions, investments, or powering blockchain networks. They form the backbone of the digital economy.

- Non-Fungible Tokens (NFTs): One-of-a-kind digital items, such as art, music, or virtual property. Blockchain verifies their uniqueness, enabling creators to monetize their work effectively.

- Decentralized Finance (DeFi) Assets: Tokens facilitating lending, borrowing, and yield farming without traditional banks, offering peer-to-peer financial services.

- Tokenized Real-World Assets (RWAs): Digital representations of physical assets like real estate shares or art pieces, democratizing access to high-value investments.

What makes digital assets revolutionary? They’re programmable, easily transferable, and can generate passive income via staking or automated royalties. For example, NFT creators can receive a percentage of every resale, ensuring long-term earnings.

The Rise of Digital Assets: Historical Evolution and Current Market Trends

The story of digital assets began in 2009 with Bitcoin’s creation as a decentralized alternative to traditional money amid the global financial crisis. By 2015, Ethereum introduced smart contracts, paving the way for NFTs and DeFi. The 2021 boom propelled market caps to new heights, followed by a 2022-2023 downturn, but 2025 marks a strong rebound driven by institutional interest and regulatory clarity.

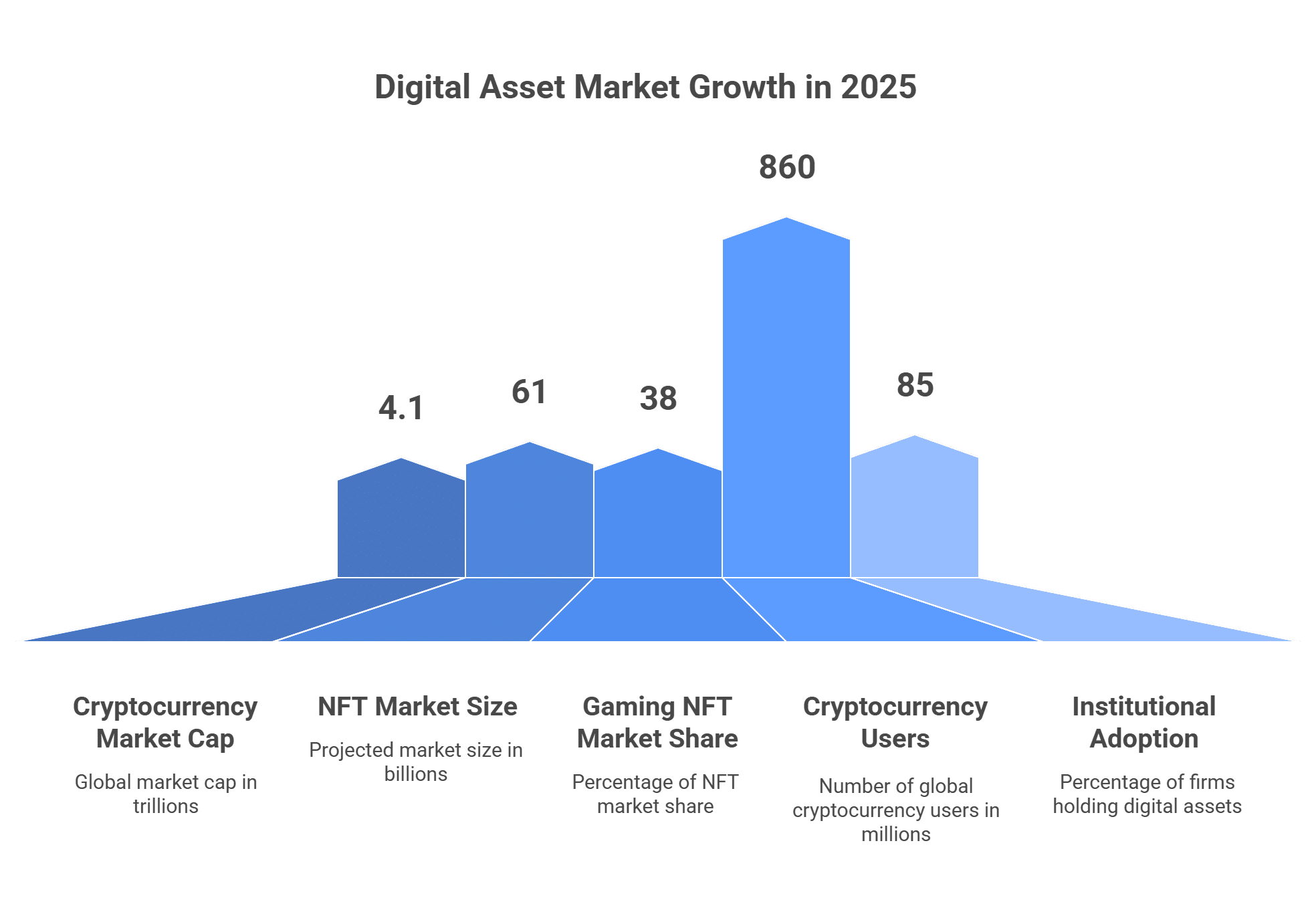

As of September 2025, the global cryptocurrency market capitalization hovers around $4.1 trillion, reflecting a 92% year-over-year growth fueled by renewed confidence and broader adoption. The NFT market is projected to reach approximately $61 billion in 2025, with a compound annual growth rate of around 30-40%, primarily driven by gaming (38% market share) and digital collectibles.

Insight on Adoption Trends: Worldwide, over 860 million people now own cryptocurrencies, up significantly from previous years. India and the United States lead the global crypto adoption index, with emerging markets like Pakistan, Vietnam, and Brazil close behind. This surge highlights digital assets’ role in financial inclusion, especially in regions with unstable currencies.

Institutions are diving in: About 85% of firms either hold digital assets or plan to allocate in 2025, with many expecting to increase their holdings. Blockchain’s efficiency in cutting intermediaries can reduce transaction costs by up to 80%, making it attractive for businesses.

Ways Digital Assets Are Transforming Value Creation

Digital assets are shifting value from centralized systems to accessible, user-controlled models. Here’s a breakdown of their impact:

1. True Ownership and Digital Scarcity

Value in the physical world stems from scarcity and usefulness. Digital assets replicate this through blockchain, preventing unlimited duplication. A famous NFT artwork sold for $69 million in 2021, demonstrating how digital items can fetch premium prices. In 2025, virtual land in metaverses like Decentraland commands millions, with one parcel selling for $2.4 million last year. This “digital scarcity” allows instant, global transfers with verifiable ownership. To engage users with these virtual worlds, businesses often hire mobile application developer teams to build intuitive apps for seamless access to NFT marketplaces and metaverse platforms.

2. Innovative Economic Models Powered by Digital Assets

- Play-to-Earn Gaming: Platforms like Axie Infinity enable players to earn real-value NFTs and tokens. At its height, some users in developing countries out-earned traditional jobs, promoting economic empowerment.

- Creator-Focused Economies: Marketplaces such as OpenSea let artists sell NFTs directly, skipping middlemen. Built-in royalties mean creators earn 10% or more on every resale.

- Asset Tokenization: Everyday investors can now own fractions of luxury items like fine wine or property. Tokenized funds launched in 2024 manage billions, opening doors to previously exclusive markets.

Case Study: Bitcoin as Digital Gold: With a market cap exceeding $2.3 trillion in September 2025, Bitcoin has delivered over 10,000,000% returns for early 2010 buyers at $0.08 per coin, illustrating the profit potential of digital assets.

3. Accessibility and Financial Inclusivity

Anyone with a smartphone can participate. The UAE leads with high adoption rates, while DeFi offers annual yields of 10-20%, outpacing bank savings. This empowers the 1.7 billion unbanked globally to access finance.

Data Highlight: Daily crypto trading volumes surpass $100 billion, providing liquidity comparable to major stock exchanges.

Navigating Challenges: Risks in the Digital Assets Space

Despite their promise, digital assets come with risks. Price volatility can cause 10-20% daily swings. Regulatory landscapes are evolving; 2025 has seen U.S. SEC and CFTC initiatives for clearer frameworks, but fines for unregistered tokens reach billions. Hacks, like the 2022 $600 million incident, and mining’s environmental impact remain concerns.

Additional hurdles include secure storage (custody) and classifying assets legally, such as whether NFTs count as securities. However, industry maturation and collaborations are addressing these, with expected regulations boosting trust and adoption.

Pro Tips for Safe Investing:

- Choose trusted exchanges like Coinbase or Binance.

- Enable multi-factor authentication.

- Diversify your portfolio to spread risk.

- Stay updated on regulations via official sources.

Future of Digital Assets: Projections and Emerging Trends

In 2025, trends show deeper mainstream integration. Institutional investments are rising, with firms expanding crypto services. Look for growth in RWAs, AI-enhanced trading, and Web3, where users control and monetize their data. Companies aiming to stay ahead are investing in AI software development services to integrate predictive analytics and automation into trading platforms, enhancing decision-making in the fast-paced digital asset market.

Market Projections: By 2030, the digital asset ecosystem could exceed $10 trillion, fueled by blockchain applications in supply chains and identity management. 24/7 trading and fractional ownership will enhance liquidity and inclusivity.

Expert Insight: With Bitcoin ETFs approved and stablecoins dominating flows, 2025 is a pivotal year for scaling adoption.

Conclusion: Embracing the Digital Assets Revolution

From Bitcoin’s origins to a $4.1 trillion market, digital assets are revolutionizing value by making finance accessible, innovative, and efficient. With NFTs projected at $61 billion and global users nearing a billion, opportunities abound, but approach with caution. For those starting out, educate yourself using tools like CoinMarketCap, invest gradually, and monitor regulations.

In this pixel-driven economy, informed action is key. What’s your next move in digital assets? Dive in wisely to potentially transform virtual holdings into substantial real-world gains.