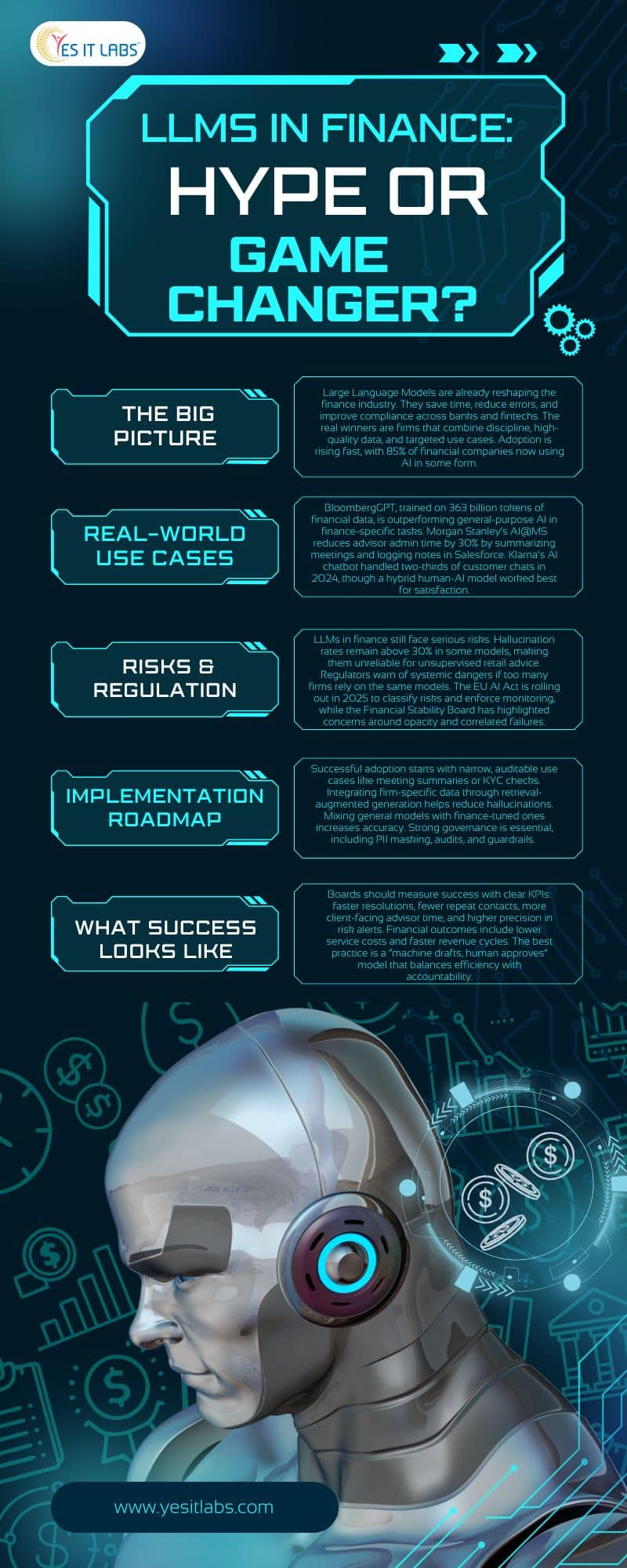

If you’re in the world of finance, whether you’re a trader crunching numbers, a banker navigating regulations, or simply curious about how AI is shaking things up, this question keeps popping up:

Are Large Language Models (LLMs) all hype, or are they truly transforming the industry?

As of August 2025, I’ve sifted through the latest reports, stats, and real-world deployments to give you a straight-shooting analysis. Drawing from fresh insights like McKinsey’s 2025 updates and ongoing regulatory shifts, I’ll break it down with a human touch. No fluff, just facts, examples, and practical takeaways.

Short Answer: They’re Already Changing the Game, But With Discipline

- LLMs are quietly revolutionizing how banks and fintechs operate behind the scenes.

- The winners are those pairing LLMs with robust controls, high-quality data, and focused, high-value applications.

- We’re past the demo stage. These models are saving hours, cutting errors, and boosting client service while staying compliant.

- But without discipline, yes, LLM adoption can veer into hype territory.

The State of Play: Why This Time Feels Different

Gone are the days of generic AI hype. Domain-specific LLMs are proving their worth, and many financial institutions now collaborate with an LLM development company to build industry-tuned solutions.

- BloombergGPT: A 50-billion-parameter model trained on over 363 billion tokens of financial data. It outperforms general models on finance tasks like sentiment analysis and entity recognition.

A 2025 SSRN paper confirms it beats open models like GPT-NeoX by wide margins in jargon-heavy financial NLP. - Morgan Stanley’s AI@MS Debrief: Powered by GPT-4, this tool summarizes wealth management meetings, drafts follow-ups, and logs notes into Salesforce. This reduces advisor admin time and strengthens client ties.

In 2025, it earned Celent’s Model Wealth Manager Award for Emerging Technologies. - The Value Stack: McKinsey estimates generative AI could add $200–340 billion annually to banking alone, driven by boosts in sales, service, and coding productivity.

Across industries, that’s part of a $2.6–4.4 trillion pie, with banking taking a hefty slice.

The Regulatory Landscape

Regulators are watching closely:

- Financial Stability Board (FSB): Warns of model opacity, correlated failures, and poor data quality, risks that could amplify market shocks.

- EU AI Act: Rolling out in phases through 2025, setting a global benchmark for risk classification and monitoring.

- India’s RBI: Proposed a finance-specific Responsible AI framework in early 2025.

Bottom line: LLMs are already moving real money by streamlining workflows inside the firewall. McKinsey’s 2025 State of AI survey shows 85% of financial firms are adopting AI, up sharply from prior years.

Where LLMs Pay Off Today

1. Front-Office Productivity

- Advisor co-pilots search notes, summarize calls, and generate compliant emails.

- Morgan Stanley’s tool reduces post-meeting admin by up to 30%, keeping CRMs updated and advisors client-focused.

2. Customer Service at Scale

- AI assistants handle routine queries.

- Klarna’s bot managed two-thirds of chats in its 2024 debut, equivalent to 700 FTEs, with resolution times under 2 minutes.

- By mid-2025, they reintroduced human agents after a 22% satisfaction dip, proving hybrid models work best.

3. Credit & Risk Workflows

- Auto-drafting memos, extracting covenant terms, and triaging AML alerts speed up reviews.

- McKinsey notes banks are seeing 20–40% efficiency gains in credit processes.

4. Research & Market Intelligence

- Finance-tuned LLMs classify events and summarize filings.

- BloombergGPT’s accuracy cuts manual parsing hours by half in some cases.

Many of these tools are built by a custom software development company in USA, ensuring compliance and scalability for global financial operations.

What’s Not Ready for Prime Time

- Unsupervised Retail Advice: JPMorgan’s IndexGPT remains internal due to hallucination risks.

- One-Model Dominance: Regulators warn of systemic risk if everyone relies on the same LLMs.

- Hallucination Rates: Still above 30% in some new models, which is dangerous for high-stakes finance.

Compliance and Risk: What Regulators Demand

For LLM deployments in finance, governance is non-negotiable:

- Risk Classification & Documentation (EU AI Act)

- Data Lineage & Drift Monitoring

- Human Oversight for critical decisions

- Integration with Model Risk Management (MRM) frameworks

If you already have MRM, you’re 70% there, just extend it to LLMs.

This aligns closely with the standards applied in Financial Software Development Services, where rigorous testing, monitoring, and compliance frameworks are built into every stage of the product lifecycle.

Implementation Playbook: Battle-Tested Steps

- Start Narrow

Focus on auditable, low-risk tasks like meeting summaries or KYC reviews. - Integrate Your Data

Use Retrieval-Augmented Generation (RAG) to reduce hallucinations. - Mix Models

Combine general LLMs for language fluency with finance-tuned models for accuracy. - Add Controls

PII masking, guardrails, and regular audits. - Iterate & Scale

A/B test against human workflows and measure KPIs before full rollout.

What “Good” Looks Like: KPIs for the Board

- Service: Higher first-contact resolution, lower handle times (Klarna: 25% fewer repeats)

- Advisor Time: Reduced admin work, improved CRM completeness

- Risk/Ops: Increased alert precision, faster cycle times

- Finance: Lower cost-to-serve, revenue gains from faster touchpoints

Human + Machine: Building Trust

The winning formula is simple: machine drafts, human approves.

This keeps hallucinations in check, maintains accountability, and passes audits without losing the human touch clients expect.

A Quick Roadmap: Quarter by Quarter

Q1: Inventory data, review security, choose 2–3 use cases, define KPIs

Q2: Pilot with small groups, gather feedback, test for bias

Q3: Harden integrations, train teams, expand coverage

Q4: Deploy multi-model strategies, continuously evaluate, involve risk teams

Final Verdict: Hype or Game-Changer?

Definitely a game-changer if scoped narrowly, powered by high-quality data, and governed like a core banking feature.

Otherwise, it risks becoming hype.

With 85% adoption and hundreds of billions in potential value, the opportunity is real.

As one X post put it: “mRNA vaccines may have been the biggest disruptor in health, but in finance, LLMs are quietly winning.”

FAQs

1. What are LLMs in Finance?

LLMs in Finance refer to Large Language Models designed or adapted for financial applications, capable of processing, analyzing, and generating human-like text from financial data, reports, and market news.

2. How can LLMs improve decision-making in financial institutions?

LLMs can analyze large volumes of unstructured financial data, summarize trends, detect anomalies, and generate actionable insights, helping professionals make data-driven decisions faster and with greater accuracy.

3. Are LLMs in Finance secure and compliant with regulations?

Yes, when implemented correctly, LLMs can comply with data privacy and industry regulations like GDPR, SEC guidelines, and FINRA rules. However, firms must ensure proper data governance, model auditing, and compliance monitoring.

4. What are the main use cases of LLMs in Finance?

Common applications include automated financial reporting, market sentiment analysis, fraud detection, regulatory compliance monitoring, personalized investment recommendations, and customer service automation.

5. Can LLMs replace human financial analysts?

While LLMs can enhance efficiency and automate repetitive tasks, they are best used as decision-support tools rather than replacements. Human expertise remains essential for strategic decision-making and contextual judgment in complex financial scenarios.