Cloud-based accounting software has become a critical tool for small and medium-sized businesses in the United States. As SMEs shift away from spreadsheets and desktop accounting systems, they increasingly demand cloud solutions that are secure, scalable, easy to use, and fully compliant with U.S. financial regulations.

Building a successful cloud accounting platform requires more than technical execution. It requires a deep understanding of SME needs, strong compliance practices, thoughtful product design, and long-term scalability. This guide explains how to build cloud-based accounting software that meets real business expectations in the U.S. market.

Why Cloud Accounting Matters for U.S. Small Businesses

American small businesses manage growing financial complexity, including multi-state tax rules, digital payments, payroll compliance, and remote operations. Cloud accounting simplifies these challenges by providing real-time access to financial data and automated workflows.

Industry trends indicate that most U.S. SMEs now rely on cloud financial tools due to cost savings, improved efficiency, and better collaboration with accountants. Businesses prefer cloud platforms because they reduce manual bookkeeping, lower the risk of errors, and support faster decision-making.

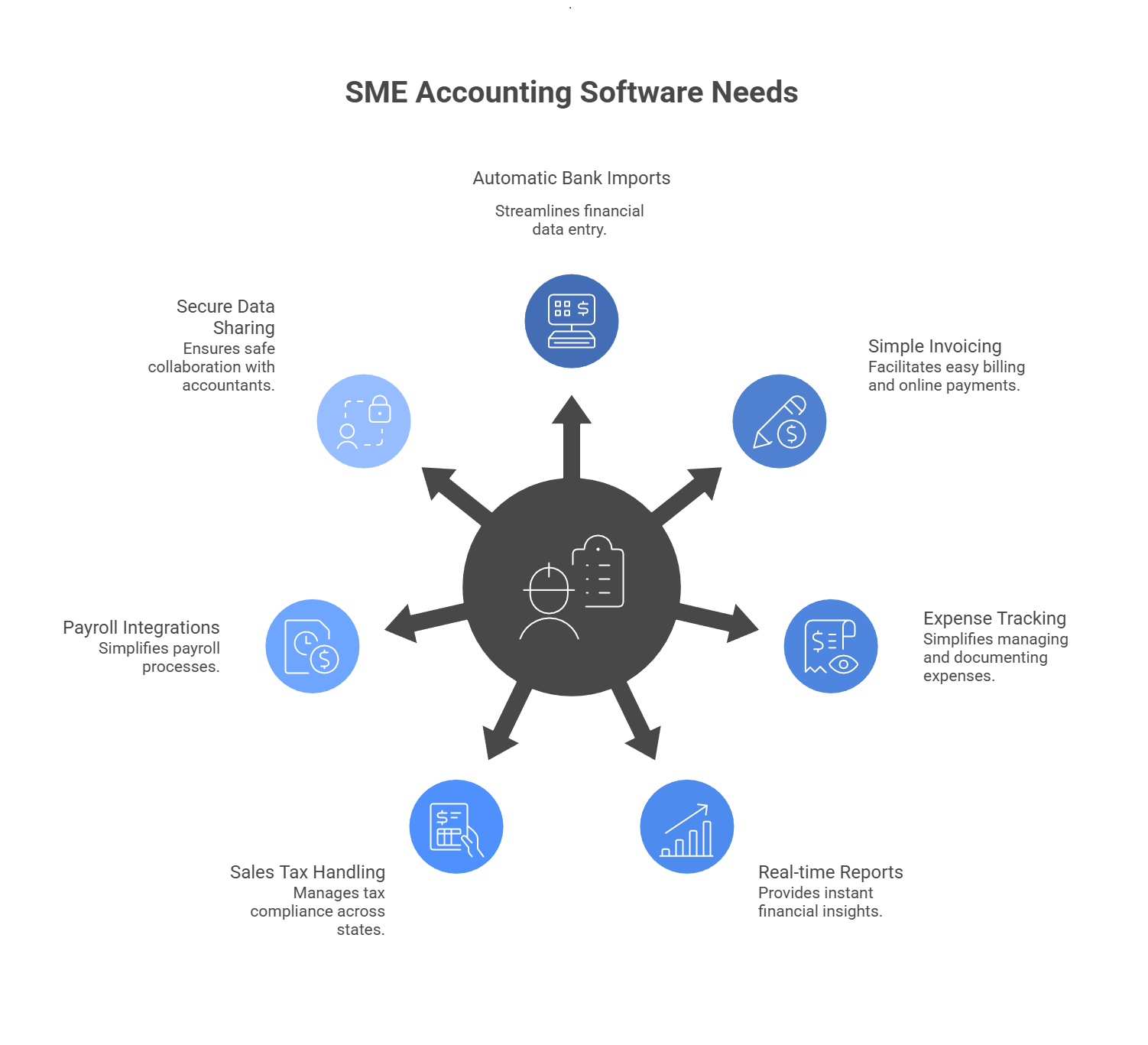

Step 1: Understand What U.S. SMEs Need Most

Small businesses want accounting software that makes financial management simple rather than complicated.

Key priorities typically include:

- Automatic bank transaction imports

- Simple invoicing with online payment support

- Expense tracking with receipt uploads

- Real-time financial reports such as profit and loss statements

- Sales tax handling across U.S. states

- Payroll integrations or built-in payroll tools

- Secure data sharing with accountants

Accounting software that reduces administrative workload and improves financial clarity delivers immediate value to SMEs.

Step 2: U.S. Compliance and Regulatory Considerations

Accounting platforms serving U.S. companies must align with local tax and financial requirements.

Important compliance areas include IRS reporting support, GAAP-compatible financial statements, accurate sales tax tracking by state, secure record retention, and audit-ready transaction logs.

Businesses also expect strong data security practices. Many companies look for vendors that follow recognized security frameworks similar to SOC 2, especially when sensitive financial data is involved.

Step 3: Building on Reliable Cloud Infrastructure

A scalable and secure cloud foundation ensures your accounting platform performs well as customer volume grows. Many development teams rely on AWS Application Development Services to build flexible backend infrastructure that supports data storage, real-time processing, automation, and third-party integrations.

A strong cloud setup should support multi-tenant environments, secure APIs, scalable databases, background job processing, and automated system monitoring.

Step 4: Define a Practical Product Roadmap

Minimum Viable Product Phase

Your MVP should focus on core functionality such as transaction tracking, invoicing, bank synchronization, user authentication, and essential reporting.

Growth Phase

Once product validation begins, expand into automated reconciliation, payroll integrations, payment processing, role-based access control, and tax reporting tools.

Scaling Phase

Advanced stages should include compliance certifications, audit logs, custom reporting dashboards, and enterprise-grade performance optimization.

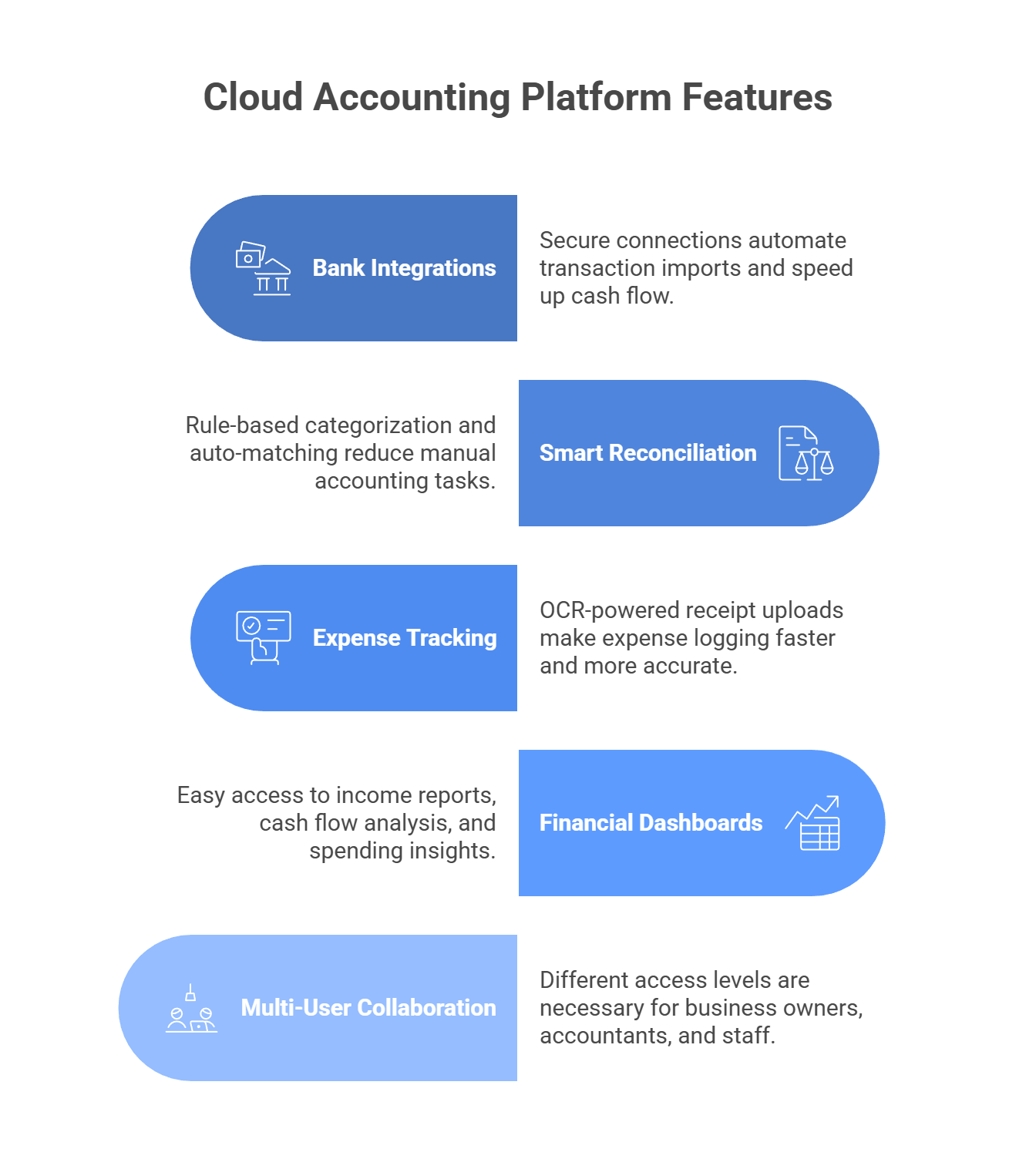

Step 5: Core Features Every Cloud Accounting Platform Needs

Bank and Payment Integrations

Secure financial connections help automate transaction imports and speed up cash flow through online payments.

Smart Reconciliation

Rule-based categorization and auto-matching reduce manual accounting tasks.

Expense and Receipt Tracking

OCR-powered receipt uploads make expense logging faster and more accurate.

Financial Dashboards

Users expect easy access to income reports, cash flow analysis, and spending insights.

Multi-User Collaboration

Different access levels are necessary for business owners, accountants, and staff members.

Step 6: Expanding with Enterprise-Grade Cloud Services

As your product grows, scalability and performance become more critical. Many companies adopt Azure cloud application development services to support enterprise-level reliability, data processing efficiency, disaster recovery planning, and high-availability architecture.

Cloud optimization ensures consistent performance during peak workloads and future expansion.

Step 7: Security Must Be a Priority

Financial software must maintain strict data protection standards.

Essential security practices include encrypted data storage, multi-factor authentication, controlled access permissions, secure identity management, ongoing vulnerability testing, and automated backups.

Strong security builds customer confidence and protects your brand reputation.

Step 8: Creating a Smooth User Experience

Even advanced accounting tools fail if users struggle to understand them.

Focus on intuitive onboarding, guided setup flows, simple dashboards, contextual tips, responsive customer support, and easy bank connection processes. A smooth experience increases adoption, engagement, and long-term retention.

Step 9: Role of SaaS Strategy in Product Success

A scalable subscription model supports predictable revenue growth and easier customer expansion. Working with a SaaS development company in USA can help align your product architecture, subscription structure, performance optimization, and long-term SaaS strategy with market expectations.

A well-planned SaaS foundation improves scalability, billing automation, and customer lifecycle management.

Step 10: Adding Financial Technology Capabilities

Advanced accounting platforms increasingly integrate financial intelligence features such as cash flow forecasting, automated categorization, and predictive reporting. Businesses that offer Banking Software Development Services can further expand product value by supporting embedded payments, digital wallets, lending modules, and financial data analytics.

These features enhance product differentiation and open additional revenue streams.

Step 11: Testing and Quality Assurance

Accounting software must deliver consistent accuracy.

Testing should include validation of accounting logic, reconciliation accuracy, report calculations, integration stability, and performance under heavy transaction volumes. Even small financial errors can impact credibility, so quality assurance must be rigorous.

Step 12: Pricing and Monetization Strategy

Popular pricing models include tier-based subscriptions, per-business pricing, paid add-ons for payroll or tax services, and referral incentives for accountants and bookkeeping firms.

Clear pricing helps small businesses choose plans confidently.

Step 13: Go-to-Market Strategy in the United States

Successful accounting platforms grow through accountant partnerships, industry-specific targeting, SEO-driven educational content, free trials, and seamless migration from competing platforms.

Trust and ease of onboarding play a major role in conversion and retention.

Key Metrics to Monitor

Track monthly recurring revenue, churn rate, activation time, active user engagement, customer lifetime value, support ticket trends, and reconciliation automation rates. These metrics reveal product health and growth potential.

Estimated Timeline and Cost

A functional MVP can typically be built within three to six months by a skilled development team. Costs vary depending on features, integrations, compliance needs, and infrastructure scale. While initial investment may be significant, cloud accounting products benefit from recurring subscription revenue and strong long-term customer value.

Final Thoughts

Building cloud-based accounting software for U.S. SMEs is a meaningful opportunity in a fast-growing market. The most successful platforms focus on solving real financial challenges, ensuring regulatory compliance, delivering strong security, and offering a seamless user experience.

When designed thoughtfully, cloud accounting software becomes a trusted business tool that supports smarter decisions, saves time, and drives long-term growth.