Imagine a world where your banking app not only tracks your spending but also calculates the carbon footprint of your morning coffee run and suggests greener alternatives. Or where investing in stocks means automatically supporting renewable energy projects without lifting a finger. This isn’t a distant eco-utopia; it’s the reality of green fintech, a burgeoning field where financial innovation meets environmental responsibility. As climate change accelerates and consumers demand sustainable options, green fintech is bridging the gap between your wallet and the planet’s well-being. In this article, we’ll explore what green fintech is, unpack its benefits and challenges, and look at its promising future, all backed by fresh data and insights to keep things engaging and authentic.

What Is Green Fintech?

At its core, green fintech is the fusion of financial technology (fintech) with sustainability goals. It’s about using digital tools like apps, blockchain, AI, and data analytics to make finance eco-friendly. Think of it as fintech’s green evolution: instead of just speeding up transactions or simplifying loans, these solutions promote environmental objectives, such as reducing carbon emissions, funding clean energy, or tracking sustainable investments. Many of these innovative tools are powered by Financial Software Development Services, which create tailored platforms to integrate sustainability metrics seamlessly into financial systems.

Green fintech isn’t one-size-fits-all. It spans apps that help individuals monitor their environmental impact to platforms that enable businesses to issue green bonds or analyze ESG (Environmental, Social, and Governance) factors. The key idea? Technology that provides sustainable financial services, channeling money toward planet-positive outcomes. Born from the fintech boom and the urgent push for sustainability, this niche has grown rapidly since the early 2020s, driven by regulatory pressures and rising consumer awareness.

Why does it matter? Traditional finance often overlooks environmental costs, but green fintech embeds sustainability into money management. It’s not just about going green; it’s about making finance smarter, fairer, and future-proof.

The Numbers: Growth and Insights

Green fintech isn’t a niche fad; it’s exploding. The global green fintech market is projected to grow at a compound annual growth rate (CAGR) of 22.4% from 2024 to 2029, outpacing many traditional sectors. The broader sustainable finance market was valued at $5.87 trillion in 2024 and is expected to grow with a 19.8% CAGR through 2034.

Some eye-opening data:

- In the first half of 2025, global fintech funding reached $44.7 billion across 2,216 deals, with climate-focused fintechs attracting significant investments despite a broader VC slowdown.

- Fintech revenues grew 21% year-over-year in 2024, compared to just 6% for traditional finance, signaling a shift toward sustainable models.

- Consumer demand is key: Gen Z and millennials, who will control $68 trillion in wealth by 2030, prioritize sustainability, with over 70% wanting eco-friendly banking options.

These stats show green fintech isn’t just good for the planet; it’s smart business. By 2025, Asia’s fintech market alone could reach $150 billion, with green innovations leading in reducing emissions through efficient financial flows.

Benefits: Why Green Fintech Wins

The perks of green fintech go beyond feel-good vibes. For individuals, it empowers smarter choices, like apps that reward low-carbon spending with cashback or discounts on electric vehicles. Businesses benefit from reduced costs via efficient ESG analytics and blockchain-secured green bonds, which can lower interest rates for sustainable projects. Many of these advanced platforms are built by a software development company in USA, ensuring robust, scalable systems that handle complex sustainability data with precision.

Broader benefits include:

- Environmental Impact: Carbon-tracking platforms have helped users cut emissions by up to 20% through behavioral nudges.

- Financial Inclusion: Crowdfunding and micro-lending apps make green projects accessible to underserved communities, funding community solar to reforestation.

- Innovation Boost: AI-driven insights enhance transparency, reducing greenwashing and directing trillions toward real sustainability.

- Economic Gains: Fintech lowers transaction costs, promotes digital payments (reducing paper use), and supports job creation in green sectors.

It’s a win-win: You save the planet while potentially saving money.

Challenges: The Roadblocks

No revolution is smooth. One major hurdle is data quality; collecting accurate climate info for reliable ESG scoring is tough, leading to inconsistencies. Fintech’s own energy demands, like blockchain’s high electricity use, can boost emissions if not managed sustainably. To address these complexities, many firms partner with an Offshore Software Development Company to create energy-efficient solutions and optimize data processes cost-effectively.

Other challenges:

- Regulation: Varying global standards make scaling hard; what’s green in one region might not qualify elsewhere.

- Adoption Barriers: Not everyone trusts or understands these tools, especially in developing regions.

- Cyber Risks: As with all fintech, security is critical, and green platforms must balance innovation with robust protection.

Solutions are emerging, like standardized data protocols and renewable-powered data centers.

Looking Ahead: Trends Shaping Green Fintech

The future is bright and green. Expect AI and machine learning to hyper-personalize sustainable investing, with apps predicting your eco-impact in real-time. Blockchain will dominate carbon credit trading, ensuring transparency, while open banking fosters data-sharing for better green decisions.

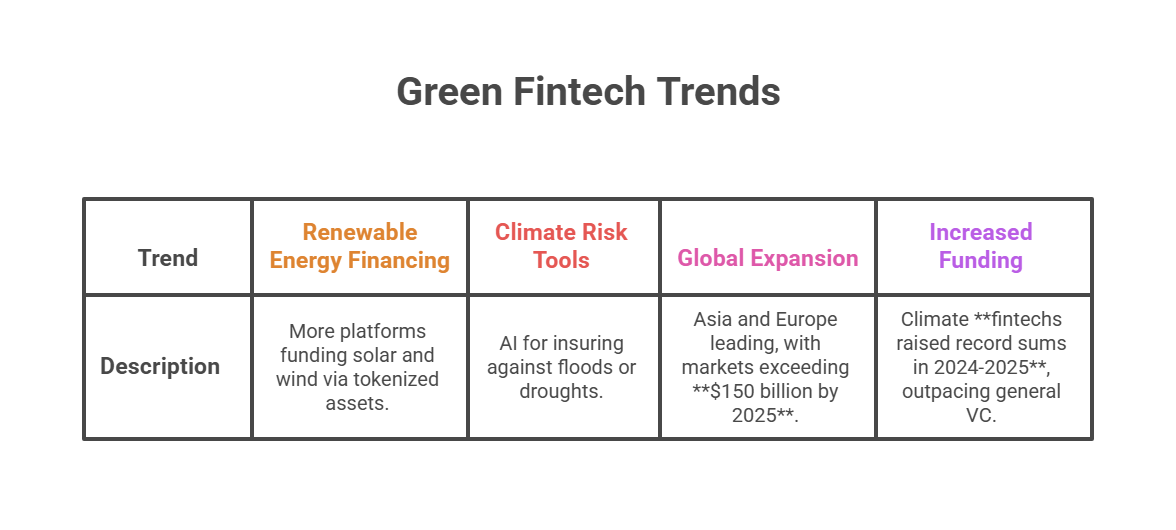

Key trends:

- Renewable Energy Financing: More platforms funding solar and wind via tokenized assets.

- Climate Risk Tools: AI for insuring against floods or droughts.

- Global Expansion: Asia and Europe leading, with markets exceeding $150 billion by 2025.

- Increased Funding: Climate fintechs raised record sums in 2024-2025, outpacing general VC.

By 2030, green fintech could redirect trillions toward net-zero goals, making sustainability the default in finance.

Wrapping Up: Your Role in the Revolution

Green fintech is a movement where money becomes a force for good. From tracking your carbon spend to investing in a cleaner world, these tools make sustainability accessible and actionable. With explosive growth (that 22.4% CAGR isn’t slowing) and real benefits like cost savings and environmental wins, it’s time to get involved. Explore sustainable investments or seek out eco-friendly financial tools. Your choices today shape a greener tomorrow; when money meets sustainability, everyone wins.